Different Types of Data

Matt Lewis

Data Consultant: 5 years

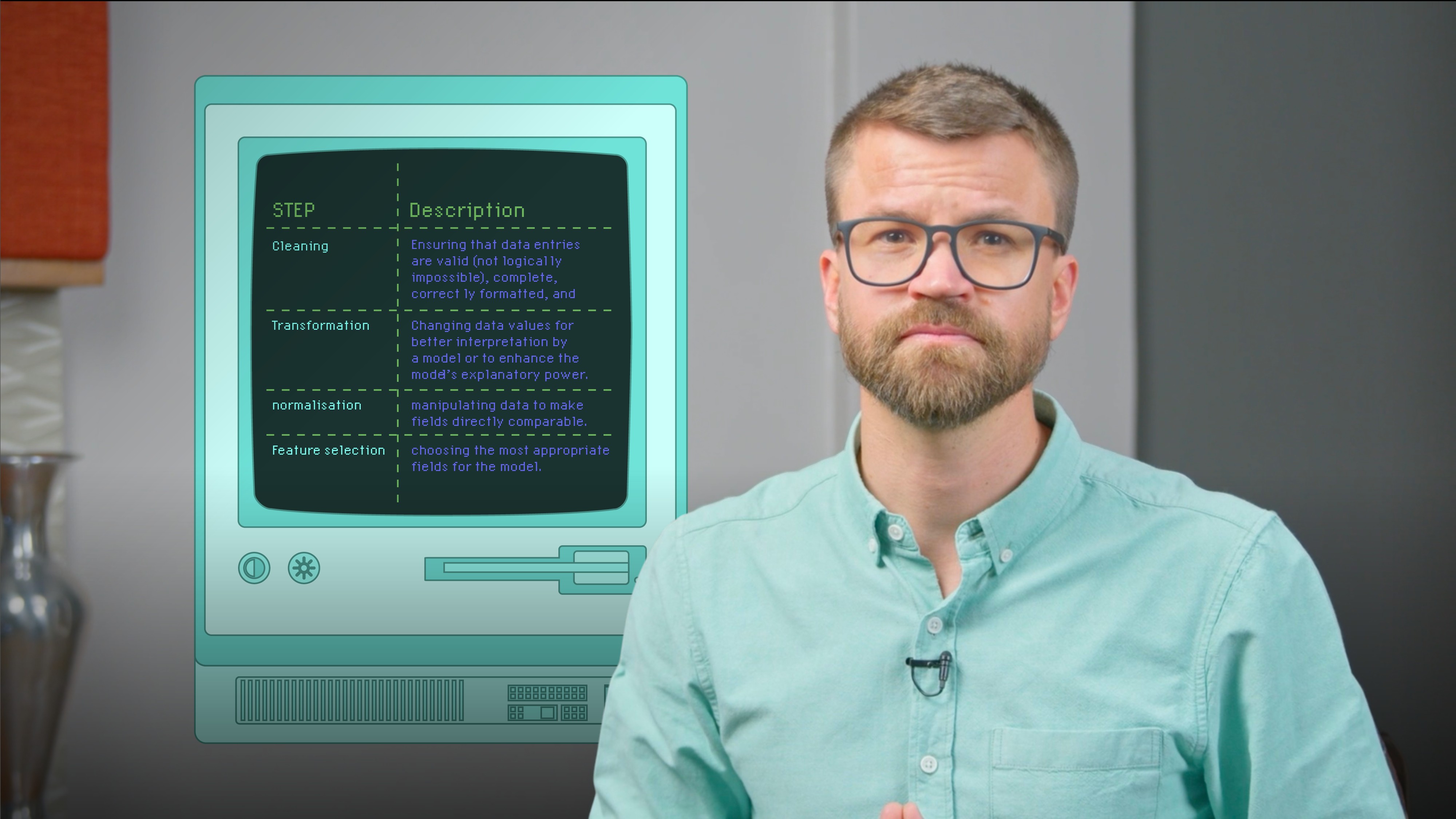

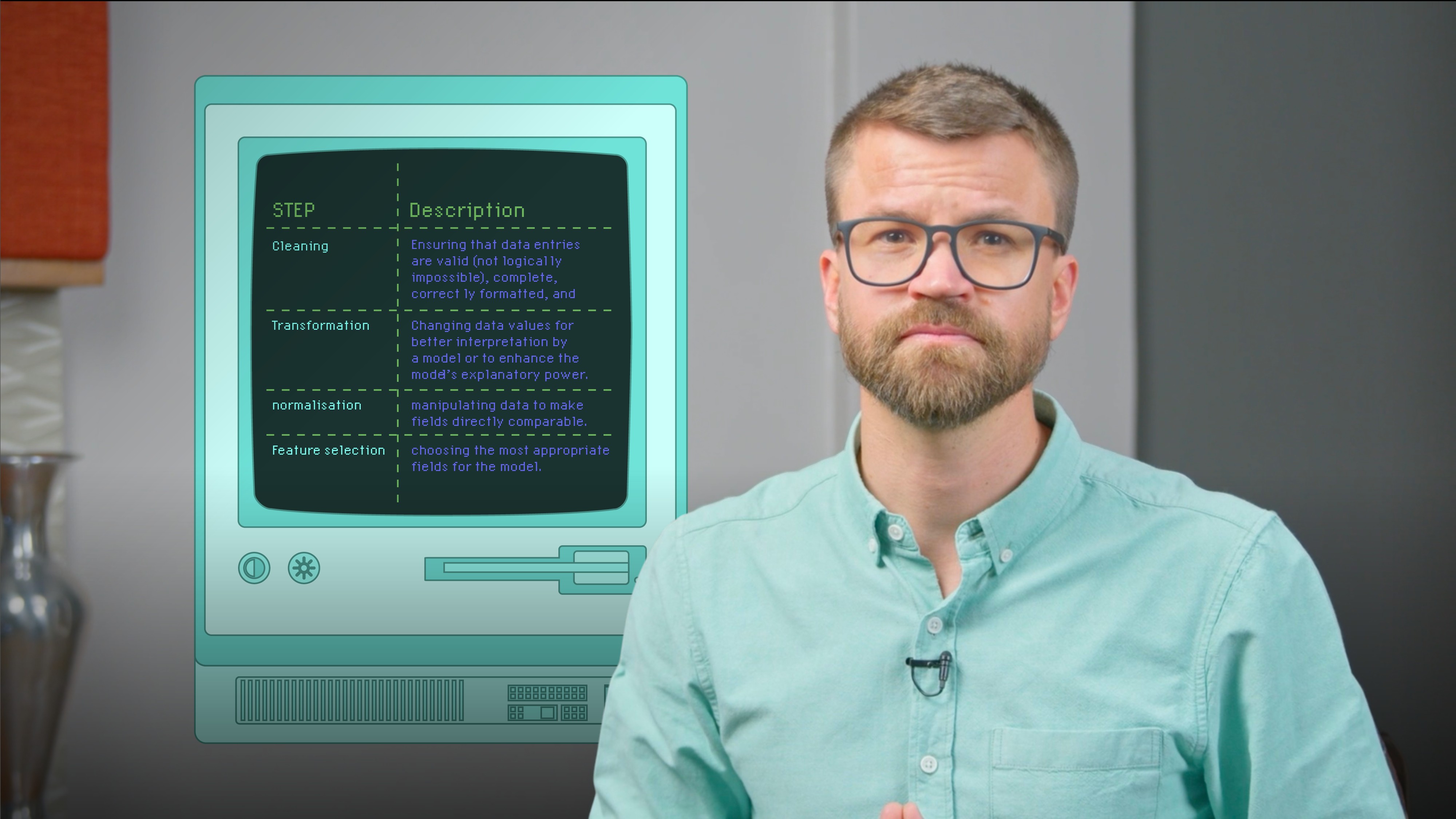

In this video, Matt explores the critical role of data quality in finance, highlighting its impact on decision-making, risk assessment, and AI outcomes. He delves into various data types used in finance, key data management practices, and essential preprocessing steps for accurate analysis. He also discusses how big data and visualisations can drive real-time insights while addressing associated regulatory challenges, providing valuable knowledge for finance professionals navigating the data-driven landscape.

In this video, Matt explores the critical role of data quality in finance, highlighting its impact on decision-making, risk assessment, and AI outcomes. He delves into various data types used in finance, key data management practices, and essential preprocessing steps for accurate analysis. He also discusses how big data and visualisations can drive real-time insights while addressing associated regulatory challenges, providing valuable knowledge for finance professionals navigating the data-driven landscape.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Different Types of Data

12 mins 41 secs

Key learning objectives:

Understand the importance of data quality and types in finance and how inaccuracies impact data science and AI outcomes

Outline key data management and governance practices, including storage solutions and compliance standards

Understand data preprocessing steps, cleaning, transformation, normalisation, and feature selection, for accurate analysis

Recognise the role of big data and visualisations in enabling real-time insights and automation, while addressing regulatory challenges

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Matt Lewis

There are no available Videos from "Matt Lewis"